Thursday, December 28, 2006

VIX and day trading

here is the VIX chart for today. From chart, we can see clearly VIX also follow trend line, support line. So when shorting or longing, pay extreme attention to VIX chart. If it's close to support/resistence, it might cause big spike in future chart:

we can put VIX and ER2 chart together to take a look.

Wednesday, December 27, 2006

Learning to Trade: The Psychology of Expertise

Learning to Trade: The Psychology of Expertise

When people hear that I am an active trader and a professional psychologist, they naturally want to hear about techniques for mastering emotions in trading. That is an important topic to be sure, and later in this article I will even have a few things to say about it. But there is much more to psychology and trading than “trading psychology”, and that is the ground I hope to cover here. Specifically, I would like to address a surprisingly neglected question: How does one gain expertise as a trader?

It turns out that there are two broad answers to this question, focusing upon quantitative and qualitative insights into the markets. We can dub these research expertise and pattern-recognition expertise, respectively. These perspectives are much more than academic, theoretical issues. How we view knowledge and learning in the markets will shape the strategies we employ and—quite likely—the results we will obtain. In this article, I will summarize these two positions and then offer a third, unique perspective that draws upon recent research in the psychology of learning. I believe this third perspective, based on implicit learning, has important, practical implications for our development as traders.

Developing Expertise Through Research

The research answer to our question says that we gain trading expertise by performing superior research. We collect a database of market behavior and then we research variables (or combinations of variables) that are significantly associated with future price trends. This is the way of mechanical trading systems, as in the trading strategies developed with TradeStation and the systems featured on the www.futurestruth.com site. We become expert, the mechanical system trader would argue, by building a better mousetrap: finding the system with the lowest drawdown, least risk, greatest profit, etc.

A variation of the research answer can be seen in traders who rely on data-mining strategies. The data-miner questions whether there can be a single system appropriate for all markets or for all time frames. To use a phrase popularized by Victor Niederhoffer, the market embodies “ever-changing cycles”. The combination of predictors that worked in the bull market of 2000 may be disastrous a year later. The data-miner, therefore, engages in continuous research: modeling and remodeling the markets to capture the changing cycles. Tools for data mining can be found at www.kdnuggets.com.

There are hybrid strategies of research, in which an array of prefabricated mechanical systems are defined and then applied, data-mining style, to individual stocks to see which ones have predictive value at present. This is the approach of “scanning” software, such as Nirvana Systems’ OmniTrader. By scanning a universe of stocks and indices across an array of systems, it is possible to determine which systems are working best for particular trading vehicles.

As most traders are aware, the risk of research-based strategies is that of overfitting. If you define enough parameters and time periods, eventually you’ll find a combination that predicts the past very well—by complete chance. It is not at all unusual to find an optimized research strategy that performs poorly going forward. Reputable researchers develop and test their systems on independent data sets, so as to demonstrate the reliability of their findings.

Can quantitative, research-based strategies capture market expertise? I believe the answer is an unequivocal “Yes!” A perusal of the most successful hedge funds reveals a predominance of “quant shops”. Several research-based stock selection strategies, such as Jon Markman’s seasonal patterns (www.moneycentral.com) and the Value Line system (www.valueline.com), exhibit long-term track records that defy mere chance occurrence.

And yet it is also true that many successful traders neither rely upon mechanical systems nor data-mining. Indeed, one of Jack Schwager’s most interesting findings in his Market Wizards interviews was that the expert traders employed a wide range of strategies. Some were highly quantitative; others relied solely upon discretionary judgment. Several of the most legendary market participants—Warren Buffet and Peter Lynch, for example—employed research in their work, but ultimately based their decisions upon their personal synthesis of this research. Quantitative strategies can capture market expertise, but it would appear that all market expertise cannot be reduced to numbers.

Developing Expertise Through Pattern Recognition

The second major answer to the question of trading expertise is that of pattern recognition. The markets display patterns that repeat over time, across various time-scales. Traders gain expertise by acquiring information about these patterns and then learning to recognize the patterns for themselves. An analogy would be a medical student learning to diagnose a disease, such as pneumonia. Each disease is defined by a discrete set of signs and symptoms. By running appropriate tests and making proper observations of the patient, the medical student can gather the information needed to recognize pneumonia. Becoming an expert doctor requires seeing many patients and gaining practice in putting the pieces of information together rapidly and accurately.

The clearest example of gaining trading expertise through pattern recognition is the large literature on technical analysis. Most technical analysis books are like the books carried by medical students. They attempt to group market “signs” and “symptoms” into identifiable patterns that help the trader “diagnose” the market. Some of the patterns may be chart patterns; others may be based upon the identification of cycles, configurations of oscillators, etc. Like the doctor, the technical analyst cultivates expertise by seeing many markets and learning to identify the patterns in real time.

Note how the pattern recognition and research answers to the question of expertise lead to very different approaches to the training of traders. In the research perspective, traders learn to improve their trading by conducting better research. This means learning to use more sophisticated tools, gather more data, uncover better predictors, etc. From a pattern recognition vantage point, however, trading success will not come from performing more research. Rather, direct instruction from experts and massed practice leads to the development of competence (again like medical school, where the dictum is “See one, do one, teach one”).

Another way of stating this is that the research viewpoint treats trading as a science. We gain knowledge by uncovering new observations and patterns. The pattern recognition perspective treats trading as a performance activity. We gain proficiency through mentoring and constant practice. This is the way of the athlete, the musician, and the craftsperson.

Can expertise be acquired by learning patterns from others and then gaining experience identifying them on one’s own? It would seem so: this is traditionally how chess champions and Olympic athletes develop. There are also examples of such expertise development in trading: Linda Raschke’s chatroom (www.mrci.com/lbr) is an excellent example of a learning device that takes the pattern recognition approach. Users of the site can “listen in” as Linda—a Market Wizard trader herself—identifies market patterns in real time. My conversations with traders who have enrolled in this service leave me with little doubt that they have acquired profitable skills, eventually moving on to becoming successful independent traders. Richard Dennis’ experiment with the “Turtles” is perhaps the most famous example of how expertise (in this case, a pattern-based trading system) can be successfully modeled for people with little market background.

And yet there are nagging doubts about the actual value of the patterns typically described in market books and tapes. A comprehensive investigation of technical analysis strategies by Bauer and Dahlquist found very little evidence for their effectiveness. An attempt to quantify technical analysis patterns by Andrew Lo at MIT found that they did, indeed, contain information about future market moves, but hardly as much as is portrayed in the popular literature. Because pattern recognition entails a healthy measure of judgment, it is very difficult to demonstrate its efficacy outside of the expert’s hands. In other words, the expert trader may be utilizing more information in trading than he or she can verbalize. This is certainly the case for chess experts and athletes. While they can describe what they are doing, it is clear that their proficiency extends well beyond the application of a limited set of rules or patterns.

This phenomenon has been the subject of extensive study in psychotherapy research. It turns out that there really is a difference in results between expert therapists and novices. But it also turns out that there is a difference between what expert therapists say they do and what they actually do in their sessions. This was noted as far back as the days of Freud. While he advocated a set of strict therapeutic procedures to be followed, Freud’s own published cases deviated from these significantly. What appears to work in therapy is not what the therapists focus on—their behavioral techniques, psychoanalytic methods, etc.—but the ways in which these are employed. Using techniques in a sensitive way that gains the client’s trust and fits with the client’s understandings is more important than the procedures specific to those techniques.

So it may be with trading. Expert traders describe their work in terms of price-volatility patterns, momentum divergences, or a nesting of cycles, but it might be the ways in which these patterns are employed that makes for the expertise. Great traders may be able to identify patterns in their work, but it is not clear that their greatness lies in these patterns.

Implicit Learning: A New Perspective

The term implicit learning began with the research of Brooklyn College’s Arthur Reber in the mid 1960s. Since that time, it has been an active area of investigation, producing numerous journal articles and books.

Implicit learning can be contrasted with the research and pattern recognition perspectives described above, in that the latter are examples of explicit learning. By conducting research or by receiving instruction in market patterns, we are learning in a conscious, intentional fashion. The implicit learning research suggests that much of the expertise we acquire is the result of processes that are neither conscious nor intentional.

A simple example drawn from Reber’s work will illustrate the idea. Suppose I invent an artificial “grammar”. In this grammar, there are rules that determine which letters can follow given letters and which cannot. If I use a very simple grammar such as

MQTXG, then every time I show a subject the letter M, it should be followed by a Q; every time I flash a T, it should be followed by an X, etc.

The key in the research is that subjects are not told the rules behind the grammar in advance. They are simply shown a letter string (QT, for example) and asked whether it is “grammatical” or not. If they get the answer wrong, they are given the correct answer and then shown another string. This continues for many trials, generally in the thousands.

Interestingly, the subjects eventually become quite proficient at distinguishing the grammatical strings from the ungrammatical ones. If they are shown a TX, they know this is right, but that TG is not. Nevertheless, if you ask the subjects to describe how they know the string is grammatical or not, they cannot verbalize any set of cogent rules. Indeed, many subjects insist that the letter arrangements are random—even as they sort out the grammatical ones from the ungrammatical ones with great skill.

Reber referred to this as implicit learning, because it appeared that the subjects had truly learned something about the patterns presented to them, but that this learning was not conscious and self-directed. Reber and subsequent researchers in the field, such as Axel Cleeremans in Brussels, suggest that many performance skills, such as riding a bicycle and learning a language, are acquired in just this way. In such cases, we learn complex competencies, but cannot fully verbalize what we know or reduce our knowledge to a set of patterns or principles.

Such implicit learning has been demonstrated in the laboratory across a variety of tasks. Cleeremans and McClelland, for example, flashed lights on a computer screen for subjects, with the lights appearing at six different places on the screen. The subjects had to press a keyboard button corresponding to the location of the light on the screen. There were complex rules determining where the light would flash, but these rules were not known by the subjects. After thousands of trials, the subjects became very good at anticipating the location of the light, as demonstrated by reduced response times. Significantly, when the lights were flashed on the screen in a random pattern, no such reduction in response time was observed. This was a meaningful finding, since the patterns picked up by the subjects were not only outside their conscious awareness—they were also mathematically complex and beyond the subjects’ computational abilities! (Like the markets, the patterns were actually “noisy”—a mixture of patterns and random events.)

It appears that much repetition is needed before implicit learning can occur. The thousands of trials in the Cleeremans and McClelland study are not unusual for this research. Moreover, it appears that the state of the subjects’ attention is crucial to the results. In a research review, Cleeremans, Destrebeckqz, and Boyer report that, when subjects perform the learning tasks with divided attention, the implicit learning suffers greatly. (Interestingly, conscious efforts to abstract the rules from the stream of trials also interfere with learning). This has led Cleeremans to speculate that implicit learning is akin to the learning demonstrated by neural networks, in which complex patterns can be abstracted from material through the presentation of numerous examples.

The implicit learning research suggests a provocative hypothesis: Perhaps expertise in trading is akin to expertise in psychotherapy. While therapists say their work is grounded in research and makes use of theory-based techniques, the actual factors that account for positive results are implicit, and acquired over the course of years of working with patients. Similarly, traders may attribute their results to the research or patterns they are trading. In reality, however, the research and patterns serve as rationales that legitimize the absorption of markets over a period of years. It is the implicit learning of markets across thousands of “trials” that makes for expertise, not necessarily the conscious strategies that traders profess.

Implications for Developing Expertise in the Markets

Such an implicit learning perspective helps to make sense of Schwager’s findings. There are many ways of becoming immersed in the markets: through research, observation of charts, tape reading, etc. The specific activity is less important than the immersion. We become experts in trading in the same way that subjects learned Reber’s artificial grammars. We see enough examples under sufficient conditions of attention and concentration that we become able to intuit the underlying patterns. In an important sense, we learn to feel our market knowledge before we become able to verbalize it. While simply “going with your feelings” is generally a recipe for trading disaster, I believe it is also the case that our emotions and “gut” feelings can be important sources of market information.

The reason for this is tied up in the neurobiology of the brain. In his excellent text The Executive Brain: Frontal Lobes and the Civilized Mind, New York University’s Elkhonon Goldberg summarizes evidence that suggests a division of labor for the hemispheres of our brains. Our right, nonverbal hemispheres become activated when we encounter novel stimuli and information. Our left, verbal hemispheres are more active in processing routine knowledge and situations. When we first encounter new situations, as in the markets, we tend to process the information non-verbally—which means implicitly. Only when we have made these patterns highly familiar will there be a transfer to left hemisphere processing and an ability to capture, in words, some of the complexity of one’s understandings. As we know from studies of regional cerebral blood flow, the right hemisphere is also activated under emotional conditions. It is not surprising that our awareness of novel patterns, whether in artificial grammars or in markets, would appear as felt tendencies rather than as verbalized rules.

o finally we get to the traditional domain of the trading psychologist! How do we know when our feelings convey real information for trading and when they merely provide interference from our conflicts over success/failure, risk/safety, etc.? Developing trading expertise is not so simple as following such slogans as “tune out your emotions when you are trading”. Much of what you might know about the markets may take the form of implicit knowledge that is encoded nonverbally and experienced viscerally.

This is an area that I am currently researching, and I welcome readers to stay in touch with me about the results. I will make sure updated information is posted in a timely way to my personal page at www.greatspeculations.com. I also hope to have my own book out on the topic early in 2003; my page will also keep readers abreast of that development. But in the remainder of this article, allow me to engage in a few speculations of my own regarding the implications of implicit learning for trading success.

1. Many are called, few are chosen – I believe the implicit learning perspective helps to explain why so few traders ultimately succeed at their craft. Quite simply, they cannot outlast their learning curves. If, indeed, it takes thousands of trials to generate successful implicit learning, a great number of traders would have been bankrupted by then. Many others might not survive that number of trials simply due to the time and energy required. It is impossible to hold a full-time job and generate the degree of immersion in the markets needed for implicit learning. On the other hand, it is impossible to obtain a full-time income from trading without developing the mastery conferred by years of experience. Part-time traders never develop expertise for the same reason that part-time chess players or athletes are unlikely to succeed. For purely practical reasons associated with raising a family, making a living, etc., few people can undergo the “starving artist” phase of skill-building.

2. Emotions interfere with trading – This is a near-universal observation among full-time traders and captures an important understanding. Fear, greed, overconfidence, self-blame—all of these can undercut even the most mechanical trading. Indeed, when Linda Raschke and I surveyed 64 traders for their personality and coping patterns, the factor of neuroticism—the tendency to experience negative emotions—emerged as a major factor associated with trading difficulties. This makes sense from an implicit learning perspective. To the degree that a trader is focused on his or her fears, self-esteem, fantasies, etc., attention is drawn away from the learning process. The problem may not be emotionalism per se; there are many highly emotional, but successful traders. Rather, the issue may be the degree to which emotions interfere with one’s cognitive processing by competing for attention. Focusing on negative emotions may be a much larger problem than actually experiencing them. Many outstanding traders “explode” when they make a rookie error. For them, however, the storm blows over quickly; less successful traders appear to be less able to let the issue go. As a result, they become caught in a cycle of blame, increasing self-consciousness, and further blame. As a psychologist, my leaning is to help traders experience their frustration and get over it quickly, rather than “overcome” it altogether. (In my chatroom session with Linda Raschke, I will be addressing how to accomplish this).

3. The advantages of learning trading vs. investing – If the internalization of complex patterns requires many thousands of observations across different market conditions, the challenge for the trader is making this process as efficient as possible. My sense is that there may be an advantage to learning trading, as opposed to investing, simply because short-term traders are apt to observe many patterns in the course of a single day or week. The investor, conversely, may note a pattern every few months or years, greatly extending the amount of time needed for implicit learning. This dynamic would help to explain why many of the most successful traders I have met have had experience working on the exchange floors. In the fast-paced environment of the floors, a trade may last seconds to minutes, with many trades placed per day. Complex research strategies and chart analyses fly out the window when time frames are compressed to that degree. Instead, traders become so immersed in the markets that they acquire the (implicit) ability to read moment-to-moment patterns of momentum and price change. This creates an ideal implicit learning environment; having so many patterns to read per day makes the development of expertise much more efficient. Ironically, it also might help account for difficulties floor traders often experience when they attempt to trade off the floor. Without the contextual cues that help them process those price and momentum shifts, floor traders lose their edge—even though they may think they are employing their same, successful trading methods.

4. Developing technologies for training traders – If we look at how experts are trained in other fields, we notice a common factor: an intensive period of apprenticeship in which the student works under a master and obtains continuous instruction and practice. Consider, for example, the cultivation of expertise in the martial arts. Many years will be spent in the dojo studying under a sensei before the black belt is conferred. Instruction alternates with practice; rehearsal of techniques alternates with the application of techniques in real-life (tournament) conditions. The online medium has created a variety of promising strategies for training traders, such as Linda’s chatroom, real-time market commentary via weblog, and services that allow simulated online trading. My sense is that we will see an accelerated shift from services that emphasize trading techniques to comprehensive trading “dojos” that incorporate real-time instruction, practice, and coaching. Already we are seeing expert instruction modules built into conventional software programs such as Metastock. This move toward implicit learning environments strikes me as a most promising application for peer-to-peer networks, as traders share research resources and trading experiences and learn from each other. (See www.limewire.org for more information on Gnutella and P2P networking).

5. Developing technologies for facilitating learning – This is my primary research interest in trading psychology. A broad array of research suggests that learning is mediated through the brain’s prefrontal cortex, which also controls attention, concentration, planning, and other executive functions. We also know that children with learning disabilities are significantly more likely than others to possess neurological deficits associated with the frontal lobes, including attention deficit hyperactivity disorder (ADHD). Elkhonon Goldberg cites considerable research that indicates we can improve the functioning of our frontal cortex through structured exercises, much as we can build our muscles in the gym. Such exercises have been used, for example, in delaying the onset and progression of Alzheimer’s disease. Is it possible, however, to develop super-states of concentration and learning in a mental gym the way that bodybuilders can hone their physiques in a weight room? I believe we can. I am currently working with Dr. Jeffrey Carmen on biofeedback strategies that directly measure regional cerebral blood flow to the prefrontal cortex. Utilizing infrared sensors to detect heat changes in the forehead (reflecting increased frontal blood flow), it is possible for traders to know exactly how much of their mental processing power is available to them at all times. Moreover, it is possible for them to learn strategies for increasing their frontal activation and maximizing their optimal learning states. This would allow traders to process each trading day (or lesson) as thoroughly as possible, creating more efficient learning.

My research to date suggests that the state of mind induced by the biofeedback exercises is not unlike the state that people enter during hypnotic induction or meditation. It is a state of relaxed and focused concentration. Such a mind frame minimizes the impact of emotional interference at the same time that it quiets the verbal, internal dialogue that permeates much of our cognitive lives. Following Goldberg’s hypothesis, I believe that the capacity to enter such states of consciousness may allow us to efficiently process novel information by facilitating right hemispheric activation, even as it dampens emotional arousal and the interference of critical, verbal thinking. This very much fits with psychologist Mihalyi Csikszentmihalyi’s observations of “flow” states among highly creative and successful individuals. The learning of expertise may depend as much upon the mind state of the learner as the quality of the instructional materials.

Conclusion

I began this article with a straightforward question: How does one gain expertise as a trader? We have seen that expertise is often described as the outcome of an explicit research process or as an explicit acquisition of knowledge about recurrent patterns. Much skill-based learning, however, is acquired implicitly, as the result of processing thousands of examples. Small children learn language, for example, long before they can verbalize rules of grammar and syntax; we learn complex motor skills, such as hitting a baseball, without ever being able to capture our expertise in a way that could be duplicated by another person.

While immersion in research and in pattern recognition can indeed produce trading expertise—a finding made clear by Schwager—the key ingredient in trading development may be the immersion, not the research or the patterns per se. If this is true, efforts to find the best trading system or the most promising chart pattern are off the mark. The what of learning trading may be less important than the how. If you want to become a proficient trader, the most promising strategy is to immerse yourself in the markets under the tutelage of a master trader. You need to process example after example under real trading conditions, with full concentration, to develop your own “neural network”.

I believe the most exciting frontier for trading psychology is the development of tools and techniques for maximizing implicit learning processes. Such techniques would assist in the acquisition and utilization of expertise by training individuals to sustain states of consciousness in which they are open to implicit processing. As I hope to demonstrate more thoroughly in my forthcoming book, there are reasons for believing that experienced traders possess greater expertise than they are aware of. This tacit knowledge, to use Michael Polanyi’s memorable term, reveals itself during “hot streaks” in trading and those wonderful experiences where we just “know” what the market is doing and place winning trades accordingly. Too many traders look to emulate others. The secret to success, conversely, might well be to gain greater access to the expertise we have already acquired implicitly and learn to become the traders we already are when we’re at our best.

Well, if you’ve followed me thus far through a lengthy article you no doubt have much of capacity for attention and concentration needed to become a master trader! In the coming months, I hope to elaborate many of the ideas and techniques alluded to in this article, and I encourage you to stay in touch regarding new directions and developments.

With that, I will part with a last research finding from Reber. Remember those artificial grammars that people had to learn, such as MQTXG? Letters were displayed to subjects that either followed the grammar (i.e., Q could only follow M; T could only follow Q, etc.) or that did not. The subjects did not know the rules of the grammar, but over many trials could figure out which combinations of letters were right and which were wrong. Suppose, however, that the grammar is changed in the middle of the experiment, so that the new constructions follow the rules of NRSYF instead of MQTXG. Will subjects continue to display implicit learning?

The answer is enlightening. After many trials with the initial grammar, without knowing the rules, subjects will choose “MQ”, “TX”, and “QT as grammatical constructions while rejecting “QM”, “XT”, and “TQ”. Once the grammar is switched, the subjects’ learning goes out the window and their guesses retreat to chance levels. But with enough new trials, subjects pick up the new grammar and are able to recognize “NR”, “SY”, and “RS” as grammatical and reject “RN”, “YS”, and “SR”. In other words, people not only learn complex patterns implicitly; they continue their implicit learning when the patterns shift. This has major implications for the development of market expertise. The markets are always changing, but as long as we stay in our optimal learning modes, we can adapt with them.

Brett N. Steenbarger, Ph.D. is Associate Professor of Psychiatry and Behavioral Sciences at SUNY Upstate Medical University. Dr. Steenbarger is an active trader and author of The Psychology of Trading (Wiley, 2002). He writes feature columns for the MSN Money website (www.moneycentral.com) and several trading publications, including Stocks Futures and Options Magazine (www.sfomag.com). These articles and a daily trading weblog are linked at Greatspeculations.com.

交易是“失败者”游戏

什么是交易中最重要的因素?

行为改变是成功交易的关键 -- 在一些情况下,不仅关系我们如何思考,同时关系到我们如何行动。我们必须适应不断改变的情况,环境是我们无法控制的。所以我们只能改变我们所能改变的。

交易执行的重要性。如果你不能顺利买入,你也不会顺利卖出。

一般你喜欢买卖那种类型的股票?

只有一个答案。任何在移动的股票。移动所带来的风险就小,较小的份额就可以带来不错的回报。在一个凝固的市场中,你会趋向于建立较大的仓位,然而,一个新闻冲击市场而你完全没有准备.....

===============

我常说财富是在令人意想不到的一边,也许更确切的说,失败是在熟悉或大众的一边。

他 们脑子里所想的是今天他们可以从市场中赚取多少。他们注定是失败者,并不是因为他们不懂交易或市场不好,而是因为他们无法自主。最糟糕的是,他们还没有意 识到这个问题。梦想化为泡影是令人悲哀的,但是更糟糕的是,他们同时还损失金钱。有时,你可以在如此短期内损失巨额财富。每一个交易员都发生过这样的事。 多数情况是,一个交易手的计划中没有考虑过“如果我错了怎么办?”他们的思维停留在对正确的期望上。这是成为成功交易手的关键所在。在我的生涯中,这个思 想一遍又一遍地被验证。我将要告诉你的是交易的核心内容,没有一个交易者会对别人吐露这些东西。那些失败者之所以失败,是因为他们从一开始就不知道市场的 本质,不知道市场会对他们干什么。这不是任何一个人的错,只能是他们自己的责任。

在建仓和清仓时我们有交易执行成本或价格滑动,我们有交易佣金要从你的资本金中扣除。市场在很多时间内处于一个不可预测的模式中。短期和长期趋势的确存在,但不是100%的时间。

正确的持仓方法

正确的持仓方法是当它们(仓位)被证明是正确的时候你才持有。让市场告诉你的交易是正确的,永远不要等市场告诉你的交易是错误的。你,作为一个好的交易手,必须站在控制者的地位,当你的交易变坏时,你必须明白并告诉你自己这一点。

当你的交易处于正确的方向,市场会告诉你这点,你只需持住仓位。多数人却是做相反的事情,他们等市场告诉他们交易错了的时候才止损清仓。想想这个问题。如果你不是自己系统的清除那些未被证明是正确的仓位,而等市场来告诉你你的交易是错误的时候,你的风险就要高很多。

让市场来告诉你交易是正确的,然后才持仓。换句话说,交易是“失败者”游戏而不是“胜利者”游戏。交易不是一个优势游戏,如果你没有被证明是胜利者,你总是一个失败者。

如果你要等市场告诉你这个仓位是错误的话,你也许需要很长时间,这也导致更高的风险。

规则一

在一个象交易这样的失败者游戏中,我们与大众相敌对的立场开始游戏,直到被证明正确以前,我们假定我们是错的。(我们不假定我们是正确的,直到被证明错了。)

在市场证明我们的交易是正确的以前,已建立的仓位必须不断减少和清除。(我们允许市场去证明正确的仓位。)

非常重要的一点是,你必须理解我们所说的平仓标准:当仓位未被证明正确时我们平仓,我们没有时间等待市场证明你是错误的才去平仓。

我们在这里的处理方法同大多数交易者所做的有很大的差别。如果市场没有证明仓位是正确的,同时也非常有可能市场也没有证明它是错误的。如果你等待,并希望市场最终会证明你是正确的,你可能在浪费时间、金钱和精力,因为你的交易可能是错的。

如果交易没有被证明是正确的,尽早平仓。等待一个交易被证明是错的,会产生更大的价格滑动(期望执行价格和实际执行价格的差别),因为在那个时候,每一个人都获得了相同的市场信息。

这个策略的另外的一个好处是,当市场没有证明你是正确时,你没有例外的会采取行动。大多数交易者做相反的事情,他们在那时什么也不做,直到止损平仓,在那个时候,这不是他们自己的决定去清仓,而是市场让他们清仓。

你的思维方式应该这样:当你的交易是正确时,你什么也不做;而不是当你的交易不正确时,什么也不做!

大多数交易者保有他们的仓位,直到他们的交易被证明是错的。我的观点是,不要持有仓位,除非你的交易被证明是正确的。

但谁又会说一个坏交易不会转变成好交易呢?

这正是大多数交易者的想法。他们担心在他们平仓后,市场开始朝他们原先期望的方向走。但如果他们不早期割肉,那么等市场越走越远时,割肉也就变得更为困难。然而,市场的情况是,那种大损失终究会有一天把你赶出市场。

规则一强调的是:你要使你的损失越小越好,割肉越快越好。这不会总是正确的,但可以保证你能够在这个游戏中生存。

交易者通常不知道交易实际上是一个失败者游戏,那些最善于输的人最终会赢。

交易不是赌博!把它作为你的生意,在最短时期内获得最大化利润,将风险程度降到最低。这就是规则一为你所做的事情。

平仓是因为价格变化否定了我的交易,而不是因为价格变化“确认”了我的止损信号。

规则二

无例外地正确地对你的赢利股加码。

关键地方是“正确地”。你听到的最多的引用语也许是“止损”。但止损只是硬币的一面。如果没有规则二,你会发现交易甚至不是一个一半对一半的游戏。如果没有一个正确的对你赢利股加码的方法,你也许永远不能赚回你的损失。规则二保证当你交易正确的时候,你有一个较大的仓位。你总是希望在你进入趋势市场时,你有大的仓位保证更多的赢利。

规则二并不是说,因为你有一个对你有利的仓位,所以你必须增加筹码。规则二中“正确地”意味着你必须有一个合格的计划,当趋势确认后,你才合理地增加筹码。增加筹码的合理方法取决于你交易计划的时间跨度。

你也许是一个当日交易者、短线交易者、中期交易者或趋势交易者。加码标准根据每个交易计划的不同会有区别。规则二的重要性在于,当你有获利股票时,你可以获取最大利润,而同时损失的可能性在此时却是最小的。你必须合理地结合使用规则一。

规则二促使你持有好的赢利股票,并对一个正确仓位有一个正确的起始思维方法。大多数交易者在他们拥有正确交易时,有一种冲动去套现,从而证明他们是正确的。然而,正确的交易本身实际上并不能产生大多数利润。

大多数交易者同时也恐惧市场会朝相反的方向走,从而夺去他们已有的利润。普通而言,他们会让亏损股越走越远,而赢利股仅仅开始,他们就平仓出场。这是人性在市场中的反应。在交易中,人的本能不是一种合适的交易技术。

你必须让你赢利股的仓位大于你亏损股的仓位。否则,交易就不是一个一半对一半的游戏。

对 一个被证明的仓位进行加码必须予以正确地执行,这样不会在顶峰的去建立新仓位,以避免可能会受到的伤害。每次加码必须一小步一小步走。比如,你的原始仓位 有6 个合同,那么在你第一次加码时增加4 个合同,第二次2 个合同。这样通过总共三次建仓,你的原始仓位翻倍,其比例为3:2:1。

在交易的任何时候,规则一必须始终被遵守,这包括在你加码的时候,以保护你的交易避免陷入一个主要的反转中。

你的加码计划可以是一个简单的买入信号(多头)或一个卖出信号(空头)。它可以是45 度回调或支持线。

“无例外”是指加码必须不是一个交易者的主观决定是否需要加码。需要记住的是,加码的方法必须根据你的交易计划本身来决定,对某个计划是合适的加码方法未必对另一个有效。

规 则二,它只是表明你必须对正确的仓位进行加码,并且是被正确地执行。规则没有告诉你如何加码,这要在你自己的交易计划中发展出来。规则同时表明加码是没有 例外的,你不要主观决定是否需要加码。规则二的内容具有二个方面:对你正确的交易进行思维心理状态上的加强,同时增加你的仓位筹码。

对当日交易者来讲正确的方法是,当你的仓位被证明正确的时候, 你在合适的价格回调是加码。但是,对趋势交易者来讲,就不是这样。一个趋势交易者会在突破时至少加码一次。这完全依赖于你的交易计划,你的加码方法必须同你的交易计划相符。

趋势交易者是当他们正确时,仓位变大,而当日交易者是当他们错误时,减少仓位。在当日交易者出错的时候,他们的筹码可以较大;而趋势交易者出错时永远不会有大的筹码。

如果期望长期利润,你必须使用规则二。你的交易方法决定你的加码方法。你必须理解,当你的交易正确时,你要有大的仓位。

这二个规则在一起,长期而言,给你最小的损失可能,和最大的赢利可能。大的交易损失是一些交易者被赶出市场的主要原因。

你必须将这二个规则融入你的交易计划中。经验告诉我们,这些规则是你在市场中生存的基础,并达到你的交易目标:以最小的风险换取最大的回报。

交易是一个输家的游戏。你必须学会如何输。最大的输家输得很少将继续留在游戏中。很明显的,小交易员输得多将会被马上清扫出局。有时出局的不是少数。

95%的交易员建立交易头寸然后等待市场证明他们拥有一个坏头寸。即使头寸是正确的,他们的下一步也是疑惑什么时候该平仓。他们的这种处理方法是人的本性。它导致他们生命中很多毫不迟疑的反应。

道何时清仓是一个常见的问题。 实际上规则二阐述的非常好,因为它说: 毫不例外的正确的压榨你的盈利。非但不是清除你的头寸,而是用恰当的标准增加你的头寸。 你只增加已经被证明是正确的头寸。

很多交易计划让交易员一直停留在一个头寸上。 不管市场是向上还是向下都这样想。这绝对是一个白痴的计划。

规则一不会保护你免于错误进场。那是你的工作。你必须在你的交易中解决你自己的冲突。

感觉正在做一个好交易就是交易中的死亡证书信号。

有一句谚语:市场永远不会错。我不想直接反对,但是我想事情并不总是这样的。但是这是我们在交易中必须遵循的。市场走向极端,这当然是对总是正确的挑战。一旦我们知道市场走向极端,我们可以在有利我们的一边下单并获得利益。

很少有交易员从中获利。你必须使用规则二榨干你的利润。通常你不理解榨干利润的重要性,而认为没有区别,因为你获得了利润。没人真正关心市场是否总是正确。市场价格是我们用来衡量我们的股票的,而且总是这样。

何时获利了结?

今天我们指出了一个明显增加头寸的情形。回头看总是很简单。 重要的是, 在你的头寸获利足够多之后,在你已经在你的头寸和有利的价格之间花了一些时间之后, 你必须确信这是你拿走利润的时候了?

等等,别拿走你的利润,增加你的头寸。 接着,如果它没有被证明正确, 拿走你剩下的利润并且期待着在另一个不同的价位重新进场。 如果你因为增加头寸并且错了而损失了几个点也没什么! 在你看见崩溃的市场后,你会因为增加头寸得到足够的利润,以至于将不会想会有第二次。

多数交易员会做一个交易然后损失大笔金额,错过了下一次的交易。 与市场不同步是很糟糕的,而且变得更糟。 在任何一次交易时都不要长时间不合拍。 那时你可以中途调整节奏。

Wednesday, December 20, 2006

NYTT's trading comments

如果查一下我盘前的position,10 次中有9次是赚的,而且赚的还不少.不过经常在后半天的拉锯中把profit变成了loss. 那么人脑在这种情况下能对系统有何帮助呢?

我现在能想出来的至少有:

1.开市后一小时内基本上是trending market.我的系统在这种环境中赢率和winning %都很高.所以放弃一小时后的trading就是一个可行的选择.simu没这样作,是因为想找方法beat市,并不是不能作.

2.在trending market时下大注,在龟市下小注. 能够分清这两种市吗? 很简单,打开intraday chart,走势向上或向下斜,有相当角度的就是trending market,接进水平的,或拉锯型,就是龟市.(或着一小时不能创新高或新低)

3.在把握大时下大注,把握小下小注或不下注. 能区分何时把握大,何时把握小吗? 我的系统能给出参考.另外通过不断的intraday pattern 的积累,能够对各种情况的概率,有相当的熟悉. 所以别看一直在输,积累的知识会从量变到质变.

开盘后一小时是trending market, 这个不会变. 这个应该和人类的通性有关.就是很多跌市想买,或升市想卖的,(与trend相反的力量)会先等等看,看能不能拿到更好的价钱. 再说如果它真变了,再找对策.现在按它不会变来作.

看看12/16的市,和今天很象. 象在哪里? 先升后跌,而且盘中NQ很弱,一直向下, er2却很强.尾盘终于被NQ拉下来.我来假设:

1.NDX是leading index,RUT最后还要跟NDX.

2. er2很强,而NQ弱,是市场不健康的表现.

如果我假设12/16的尾盘要在今天repeat,应该是个概率高的预测. 当然我不回完全根据这个来short,但是会增加我看跌的倾向. This is one of many ways how a man's brain can help.

Sunday, December 17, 2006

江恩十二条买卖规则 [江恩总结45年在华尔街投资买卖的经验,写成以下十二条买卖规则]

江恩认为,决定趋势是最为重要的一点,对於股票而言,其平均综合指数最为重要,以决定大市的趋势。此外,分类指数对於市场的趋势亦有相当启示性。所选择的股票,应以根据大市的趋势者为主。

在应用上,他建议使用三天图及九点平均波动图。三天图的意思是,将市场的波动,以三天的活动为记录的基础。这三天包括周六及周日。三天图表的规则是,当三天的最低水平下破,则表示市场会向下,当三天的最高水平上破,则表示市场会出现新高。

“九点平均波动图”的规则是:若市场在下跌的市道中,市场反弹低於9点,表示反弹乏力。超过9点,则表示市场可能转势,在10点之上,则市势可能反弹至 20点,超过20点的反弹出现,市场则可能进一步反弹至30至31点,市场很少反弹超过30点的。对於上升的市道中,规则亦一样。

二: 在单底,双底或三底水平入市买入

当市场接近从前的底部,顶部或重要阻力水平时,根据单底,双底或三底形式入市买卖。

不过投资者要特别留意,若市场出现第四个底或第四个顶时,便不是吸纳或沽空的时机,根据江恩的经验,市场四次到顶而上破,或四次到底而下破的机会会十分大。

在入市买卖时,投资者要紧记设下止蚀盘,不知如何止蚀便不应入市。止蚀盘一般根据双顶/三顶幅度而设於这些顶部之上。

三: 根据市场波动的百分比买卖

顺应市势有两种入市方法:1) 若市况在高位回吐50%,是一个买入点。2) 若市况在底位上升50%,是一个沽出点。此外,一个市场顶部或底部的百分比水平,往往成为市场的重要支持或阻力位,有以下几个百分比水平值得特别留意。

1) 3~5%

2) 10~12%

3) 20~25%

4) 33~37%

5) 45~50%

6) 62~67%

7) 72~78%

其中,50%,100%以及100%的倍数皆为市场重要的支持或阻力水平。

四: 根据三星期上升或下跌买卖

1)当趋势向上时,若市价出现三周的调整,是一个买入的时机。

2)当趋势向下时,若市价出现三周的反弹,是一个沽出的时机。

3)当市场上升或下跌超过30天时,下一个留意市势见顶或见底的时间应为42至29天。

4)若市场反弹或调整超过45天至49天时,下一个需要留意的时间应为60至65天。

五: 市场分段波动

在一个升市之中,市场通常会分为三段甚至四段上升的。在一个下跌趋势中,市场亦会分三段,甚至四段浪下跌的。

六: 根据五或七点上落买卖

1)若趋势是上升的话,则当市场出现5至7点的调整时,可作趁低吸纳,通常情况下,市场调整不会超过9至10点。

2)若趋势是向下的话,则当市场出现5至7点的反弹时,可趁高沽空。

3)在某些情况下,10至12点的反弹或调整,亦是入市的机会。

4)若市场由顶部或底部反弹或调整18至21点水平时,投资者要小心市场可能出现短期市势逆转。

七: 成交量

江恩认为,利用成交量的纪录以决定市场的走势,有以下面两条规则:

第一,大成交量经常伴着市场顶部出现。

第二,市场下跌,成交量续渐缩减的时候,市场底部随即出现。

第三,成交量的分析必须配合市场的时间周期,否则收效减弱。

第四,当市场到达重要支持阻力位,而成交量的表现配合见顶或见底的状态时,市势逆转的机会便会增加。

八: 时间因素

江恩认为在一切决定市场趋势的因素之中,时间因素是最重要的一环。原因有:

1. 时间超越价位平衡

第一,当市场在上升的趋势中,其调整的时间较之前的一次调整的时间为长,表示这次市场下跌乃是转势。此外,若价位下跌的幅度较之前一次价位高速的幅度为大的话,表示市场已经进入转势阶段;

第二,当时间到达,成交量将增加而推动价位升跌。

第三,在市场分三至四段浪上升或下跌时候,通常末段升浪无论价位及时间的幅度上都会较前几段浪为短,这现像表示市场的时间循环已近尾声,转势随时出现。

2. 转势时间

江恩特别列出,一年之中每月重要的转势时间如下:

1月7日至10日及1月19日至24日

2月3日至10日及2月20日至25日

3月20日至27日

4月7日至12日及4月20日至25日

5月3日至10日及5月21日至28日

6月10日至15日及6月21日至27日

7月7日至10日及7月21日至27日

8月5日至8日及8月14日至20日

9月3日至10日及9月21日至28日

10月7日至14日明亮10月21日至30日

11月5日至10日及11月20日至30日

12月3日至10日及12月16日至24日

在上面所列出的日子中,相对於中国历法中的24个节气时间。从天文学角度,乃是以地球为中心来说,太阳行走相隔15度的时间。

3. 市场趋势所运行的日数

除了留意一年里面,多个可能出现转势的时间外,留意一个市场趋势所运行的日数,是异常重要的。由市场的重要底部或顶部起计,以下是江恩认为有机会出现转势的日数:

(1)7至12天

(2)18至21天

(3)28至31天

(4)42至49天

(5)57至65天

(6)85至92天

(7)112至120天

(8)150至157天

(9)175至185天

4. 周年纪念日

江恩认为,将市场数十年来的走势作一统计,研究市场重要的顶部及底部出现的月份,投资者便可以知道市场的顶部及底部会常在哪一个月出现。要留意的包括:

第一,市场的重要顶部及底部周年纪念日。纪念日的意义是,市场经过重要顶部或底部後的一年、两年,甚至十年,都是重要的时间周期。

第二,重要消息的日子,当某些市场消息入市而引致市场大幅波动。此外,消息入市时的价位水平,这些水平经常是市场的重要支持或阻力位水平。

九: 当出现高低底或新高时买入

1. 当市价开创新高,表示市势向上,可以追市买入。

2. 当市价下破新底,表示市势向下,可以追沽。不过,在应用上面的简单规则前,江恩认为必须特别留意时间的因素,特别要注意:

1) 由从前顶部到底部的时间;

2) 由从前底部到底部的时间;

3) 由重要顶部到重要底部时间;

4) 由重要底部到重要顶部的时间。

江恩在这里的规则,言下之意乃是指出,如果市场上创新高或新低,表示趋势未完。若所预测者为顶部,则可从顶与顶之间的日数或底与顶之间的日数以配合分析; 相反,若所预期者为底部,则可从底与底之间及顶与底之间的日数配合分析,若两者都到达第三的日数,则转势的机会便会大增。

除此之外,市场顶与顶及底与顶之间的时间比率,例如:1倍、1.5倍、2倍等,亦为计算市场下一个重要转势点的依据。

十: 决定大市趋势的转向

根据江恩对市场趋势的研究,一个趋势逆转之前,在图表形态上及时间周期上都是有迹可寻的。

在时间周期方面,江恩认为有以下几点值得特别留意:

1.市场假期━━市场的趋势逆转,通常会刚刚发生在假期的前後。

2. 周年纪念日━━投资者要留意市场重要顶部及底部的1,2,3,4或5周年之後的日子,市场在这些日子经常会出现转势。

3.趋势运行时间━━由市场重要顶部或底部之後的15,22,34,42,48或49个月的时间,这些时间可能会出现市势逆转。

在价位形态方面,江恩则建议:

1)升市━━当市场处於升市时,可叁考江恩的九点图及三天图。若九点图或三天力下破对上一个低位,表示市势逆转的第一个讯号。

2)跌市━━当市场处於跌市时,若九点图或三天图上破对上一个高位,表示市势见底回升的机会十分大。

十一: 最安全的买卖点

出入市的策略亦是极为重要的,江恩对於跟随趋势买卖,有以下的忠告:

(1)当市势向上的时候,追买的价位永远不是太高。

(2)当市势向下的时候,追沽的价位永远不是太低。

(3)在投资时紧记使用止蚀盘以免招巨损。

(4)在顺势买卖,切忌逆势。

(5)在投资组合中,使用去弱留强的方法维持获利能力。

至於入市点如何决定,江恩的方法非常传统:在趋势确认後才入市是最为安全的。在市势向上时,市价见底回升,出现第一个反弹,之後会有调整,当市价无力破底 而转头向上,上破第一次反弹的高点的时候,便是最安全的买入点。止蚀位方面,则可设於调整浪底之下。在市势向下时,市介见顶回落,出现第一次下跌,之後市 价反弹,成为第二个较低的顶,当市价再下破第一次下跌的底部时,便是最安全的沽出点,止蚀位可设於第二个较低的顶部之上。

十二: 快市时价位上升

市价上升或下跌的速度,为界定不同市势的准则。江恩认为,若市场是快速的话,则市价平均每天上升或下跌一点,若市场平均以每天上升或下跌两点,则市场已超 出正常的速度,市势不会维持过久。这类的市场速度通常发生於升市中的短暂调整,或者是跌市中的短暂时间反弹。在应用上面要特别注意:江恩所指的每天上升或 下跌一点,每天的意思是日历的天数,而非市场交易日,这点是江恩分析方法的特点。在图表上将每天上升或下跌10点连成直线,便成为江恩的1 X 1线,是界定市好淡的分水岭。若市场出现升市中的调整或跌市中的反弹,速度通常以每天20点运行,亦即1 X 2线。

江恩其中一个重要的观察是:“短暂的时间调整价位”。江恩认为,当市场处於一个超买阶段,市场要进行调整,若调整幅度少的话,则调整所用的时间便会相对地长。相反而言,若市场调的幅度大的话,则所需要的时间便会相对地少。

Wednesday, December 13, 2006

每日SP500等走势猜测 (by 诸葛神算 at daqian)

http://web.wenxuecity.com/BBSView.php?SubID=finance&MsgID=588645

每日SP500等走势猜测(Guesstimates everyday)

S&P 500: Because SP 500 breakout the 1407.89 level and the last 5 sessions, fund managers are trying to hold above that level, I hereby change my target to 1434.11 ( on Jan. 5 of 2007) and if above that, 1455 (on Feb 12th of 2007), when will be the last target as my previous said. I do believe it topped on 11/27/2006 and this is just an extension price rally. The 1434 or 1455 level should be depended on if NASDAQ and Dow breakout the 2468.42 and 12365 respectively and thereafter, I will change the bull market time cycle ended on 2/12/2007, when should be the last date for the Bull Run. And between now and 2/12/2007, we should have a correction on 1/5/2007 and SP should pull back around to 1415 level.

I still think SP will have a small rebound from Dec. 13 to Dec. 29 of this year to form the last top to 1434.11. I still keep target for next bear market with 1300-1295 or 1273-1276, starting on Feb 12th of 2007, ending on 15th of May, 2007. At the next year end, we should see SP at 1487.

Next few days, it should be 1434 soon.

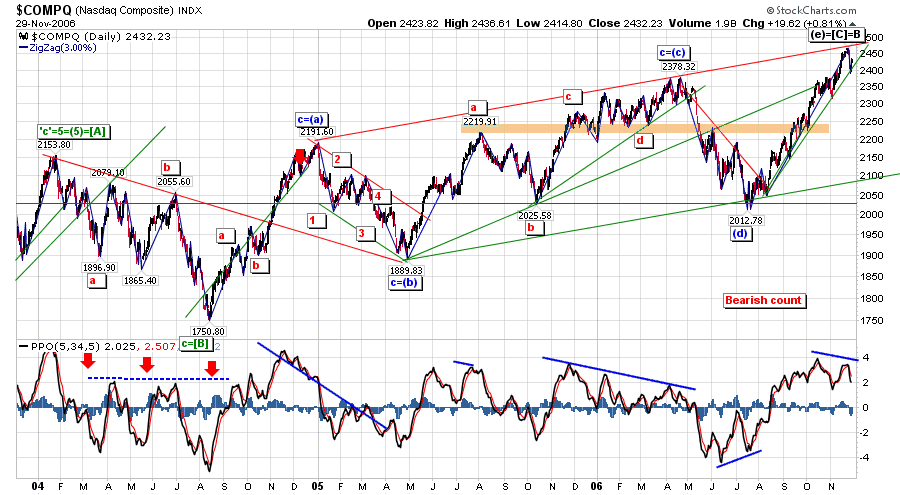

Nasdaq: I keep my target for this round Nasdaq bull market at 2468.42 with top on 11/27/06. However, if it breaks out 2468 level because of its company SP’s strong movement, it will move to 2520.64 on 2/12/07. My target for NASDAQ at next round bear market is 2139 till 5/15/07.

(Here is a number for my prediction use: 2012.78=3000-987, you can figure it out if you try your best).

Today, it might reach 2450 or so and it should breakout 2468 this week. If not, we might start a bear market early and the date 11/27/06 will be formally marked as bear market by me.

Dow: my target for this round of bull market is 12360 (reduced from 12409 to 12360) with top on 11/29/06. However, if SP keeps its current strength, I would predict Dow will be around in 12737 with spike possible 12816 till 2/12/07. After it reaches 12603 level, it should have a small pull back around to 12390 but finally it will reach 12737 level or 12816. (again, 12360=11750+610).

The down leg for next bear market is 11155 which should start on 2/12/07 to the end on 5/15/07.

It should get a sharp rally from Dow today with triple digital gain.

Euro-US $: I keep bullish for euro and every pull back is a chance to add more. Since Euro breaks 1.3000, I think it will go to 1.3480 on 1/14/07. My finally target is 1.5000 on 12/13/07. It should breakout 1.3364 this week.

US $-Yen: I keep US$ bearish. Yen pulled back to 116.90, and it should start toward 113.50 on 1/4/07 and I reduce my final target from 113 to 109 which should be on 2/14/07 and my longer term target 100 should be on 12/13/07.

December Crude oil CL: my target for this round of oil bear market is 50.47 first until May 30 of 2007 (changed date here). My final target for it is 39.97 on 4/9/08.

It might rebound to 65.80 on next 2 weeks then I think it will continue downward to 58.

December Natural gas NG: my target for the seasonal bull market is 9.6 (removed 10.6) on Jan 12, 2007.

December Gold GC: I changed my view to a little bit bullish market for gold in mid term. My target for this round small bull market will be between 550 and 730. With my MFB theory, it will first trade around 700 till Mar. 29, 2007, then down 550 until Sep. 5, 2007, then rebound to 650 at the end of 2007 and I would see it would be 450 in 2008.

I would expect it will down to 583 in next few weeks and then resume it upward to 700.

December Silver SI: I changed my target for silver to 17.25 from 15.02.It will trade to all time high around 15 on 1/24/07 (changed date) and 17.25 on Mar. 29, 2007 and then down to 11.50 on Sep. 5, 2007.

Next few days after it overcomes the 14.4, it should move to the direction all time high.

December 10 year notes ZN: I start to believe notes should not move faster than I expected and I drop my bullish view to neutral. Although it was near my predicted target around 109-26 on Dec. 6, 2006, I would not expect it will up fast. It should stay around 106 to 109 for at least 2 months because I expect the US rate cut will be postponed longer time (might after June or very later of next year).

It should top in short term at 109-20 on Dec. 6, 2006, and after one more test the high, it should start to move lower to 107 on 1/12/07 and 106 on 2/20/07.

GOOG: I still keep my old words here for goog: “it will breakout 500 to 510 and my target is 479, then down to 369, finally 280 bottom”

However, I would add time frame here. The 510 is tested on 11/22/06 ( at price 113) which I believe historic top. Then it starts downward. Now it is 481 and it should breakout 479 then move to 440 on 12/19/06 or 1/5/07. After retest 465, it should move to 404 on 1/17/07, then 369 on 2/12/07. After a small consolidation, it should move to 331 on 4/4/07 and down to 280 on 5/1/07 then start a huge renounce.

BIDU: here I am seriously predicting it. From my MFB theory, the target should be around 139 (also possible 148). Since 128.68 is also big line for MBT, I also think it may top here if it can’t breakout in next few days.

The price will change big on 12/19/06 (this date exactly as goog time frame) in either way or I bet it will down there. If (here is only if) it trade with goog, it should down same time frame as goog. But I would see it will down much slower than GOOG because its time frame is much longer then goog.

It will stay above 117 at least for some weeks then start to show weak sign.

All prediction is based on my personal experience. Charts are available on my blog.

I try to update it every week (everyday seems impossible).

Saturday, December 09, 2006

股票的运动规律:如何判断趋势 (by entry at 大千)

entry's blog: http://blog.wenxuecity.com/myblog.php?blogID=4689

In general stocks go through 4 phases:

1. bullish sideways movement

2. trend up

During trending up process, there are two pullback characteristics

a. First degree (pullbacks lasting less than 4 days)

b. Second degree (pullbacks lasting less than 14 days)

c. Longer than 14 days( a new base is under way)

3. bearish sideways movement

4. trend down

Out job is to identify which stock is in bullish trading range and which is in bearish. Again price and volume are the most factors to do this.

Friday, December 08, 2006

期权交易粗浅心得(转自MTBBS)

http://www..com/pc/pccon.php?id=1386&nid=9185&s=all

作者:volatility

我的一个朋友的朋友,也是职业option trader。

多年前从1万块左右做到现在几个million,中途辞了职,职业做这个。现在常年也就30%得return一年,现在更当年的做法当然不一样了,酱紫一年也好几十万了,买了几个房子,全家过上好日了。

这种例子是不多的,此人主要做option,sense和操作极佳,我朋友跟在旁边看他操作,根本不能理会其中奥妙。这个大牛,现在带几个徒弟,据说,也带出来两个可以不用上班职业炒股,每年十几万的。

曾经想学这位大师的操作,主要有这么几点:

第一,option根股票一个很大的不同是可以average down的。比如股票20块你买100股,就是2000块,如果跌倒18块,你average down在花一倍左右的钱也就把成本搞到19块,股票反弹也就是个保本。option不一样,20块22.5得call如果是$1,20个contract就是$2000,跌倒18块,call估计只有say 25c,此时花$2000块可以买到80个call。那你的成本也就40c,股票涨到19.x,你肯定就赚钱了。这是一个例子,说明option得average down比股票有效,不代表你判断完全相反也会赚钱。当然如果抱着没有只涨不跌,只跌不涨的股票的理念,有个“忍”字还是有戏的。

第二:职业trade option,绝对要day trade,以前这个版上说option不能day trade的绝对胡说八道。day trade而且反而风险比较小。为什么?要知道在这个零和游戏里,writer是赢家,也就是大部分option都是expire,而不是被exercise的。买一个out of the money option,指望hit home run是相对很小的概率。大部分的trading要避免承担太多的time value decay。这点上,这个版上但凡炒过option的都应该有很深的体会。

第三:right combo。什么时候,long + put,什么时候 short + call单方面call,单方面put,call+put, 2call+1put, 2put+1call,vertical calender要根据情况运用,而不是单一的买了一个单边hope for the best了。这个我和我朋友的sense都比较差。大师的sense实在是太牛了。

第四:right timing。不是指判断什么时候买入卖出,而是说做ER是提前2俩李白作,在ER还没有出来之前就close position了,这个我还没搞懂。然后另一个时间就是每天的开头1小时,和最后一小时是真正要投入trading的时间断。对于我们在西海岸的,这个头一个小时太难了,我是做不到的,除非是早起为了处理隔夜的position。

在第一点里,大师能做到“据对不cut loss”,这个我在实战中做不到,尽管我也average down,估计是因为我的profit taking没搞好。大师说,每个人都有适合自己的trading stragety,他的也不一定能适合其他人。我是觉得有的事情是天生的,想他这种几千只股票的历史走势熟记在心的,除了天分,就是苦功了。

基本上,我的朋友还在根大师学操作,我从一开始就放弃了,我觉得还是做比较适合自己的方式,这些年下来,不能靠这个quit job但能比fix income的投资好,我已经满足了,毕竟没有除了天分也没有那么多时间经历。当然如果我那个好友,根大师练出来了,我可能还是会受到引诱。

如上是我想对准备或刚开始做option的网友说的话。

Thursday, December 07, 2006

some thought about beginning of 2007

later half of Jan maybe ok due to short covering of futures.

below by Greenfield at daqian:

觉得被说服了,才决定要实践一下试试. 书里的意思就是说DAY TRADING就象赌场一样.是个概绿和数学的游戏.赌场有大概4%到5%的edge,所以关键就是sample size.只要SAMPLE SIZE够大,算上那些输赢很大的outliners, 4%到5%的赢率是肯定的事情. 做DAY TRADING就象开赌场的人. 每个决定都以概率和risk/reward比例为根据,加上严格控制风险,加大交易量,你就能赢.

Wednesday, December 06, 2006

Monday, December 04, 2006

2007年的大势判断及可能投向zt

b. 大体上,中美股市都有一个渐渐形成的十年周期,这既和实体经济活动相关,又和股市自身的运行规律相符合,这个十年周期就是,每一个新十年的前五年跌,中间缓步转势,后几年步入上涨直至泡沫丛生,据此判断中美牛市周期可能会持续到2010年

c. 美国股市走牛的实体基础是产业转型后步入强劲期,中国股市走牛的基础是制造业在经历前20年的摸索和奠定基础后进入强盛期,两国互补,实际都受惠于全球化 的推广和深入,美国产业升级后服务业 金融业 零售消费业 原创性高技术是发展主流,中国则是制造业 物流业 部分金融业 部分消费行业成为发展主流,这些领域,也是投资重点参考区域

d. 人民币升值背景下,许多资产,尤其是稀缺性资产等待重估,这会在日后渐显出来,也制造大量机会

国内和美国步伐跟的更紧了,美国今年也是大盘蓝筹行情,中小盘不但不涨还有不少在跌,涨的好的也是金融保险钢铁之流,全球化了,呵呵;这次中美欧范围内的 牛市,核心是全球化的延伸及其成果的收获,中美各有得益,符合这个走向的产业和个股,自然会是好的投向

Friday, December 01, 2006

一个牛市,一个巨大的牛市 (by good etc at trader168)

http://trader168.com/bbs/viewtopic.php?f=4&t=2716&st=0&sk=t&sd=a

good:

一个牛市,一个巨大的牛市摆在我们面前.

美国经济尽管有这样那样的问题,inflation, high deficit, losing manufactory.但是我们要跳出美国这个小圈子,放眼世界,我们现在可能是人类历史上最好的时期

1. 冷战结束加上公开市场,Russian/East Europ/China/India向自由经济注入了超过1B的廉价劳动力.

2. High energy/commodities price 帮助资源丰富的国家经济振兴,象russian, brazil, canada, australia, south afica.

3. 以india/china/russia为首的新兴市场开始消费了,特别是中国,加上2008奥运会,而且根据韩国的经验,after olympic,there will be another economic booming.

4. 在新兴市场的带动下,West europe/Japan的经济也开始好转.

5. 除了中东之外,世界的其他地区是相对和平的.我以前是比较bearish的,看过一个paper,对比29年的大股灾和2000年的crash,非常相 象,而且1929年后,Dow有一个很长的低落期.可我一想,那时候紧接着,就是二战,怎么可能涨哪.和现在的环境没发比啊.

(grus2003: 2000和1929完全是两个概念.1929-1931米国的GDP下挫40%,2000以后波动也就1-2%而已。)

其实感觉上,现在的全球经济和1920年代的美国经济很相象,都是在产业革命的背景下,有着巨大的未开发市 场.我们面临的inflation和high deficit在这么大市场面前,根本不是问题.就象暴饮暴食(inflation)和一屁股债(high deficit)对一个50岁的中年人是大问题,对一个20多岁的年轻人而言不是问题一样.

我们一定会看到较高的inflation,因为高的commodities price eventually will come to america, which is mostly absorbed by the manufactoring country - china at this time.但是超过1B的low income labor will offset this increase.所以我们一定会看到高的inflation,但不会高的离谱,象70'和90'初一样.

在这个大趋势下,有的行业会很好,有的会很差.象interest senstive financial industry will be bad because of high interest rate. 象NYX/NMX这种做股票市场的,就会很好,因为美国的世界金融业中心的地位不会动摇,公司融资的最好的地方还是美国的股票市场.

to be continued....

Makes sense. The US for the first time does not serve as the anchor of the global economy. While the us economy is going down, the rest of the world has picked up speed. Affluent emerging markets without financial markets as well-developed, well-regulated, diversified and liquid would like to pour their money into the US

greedy_is_good:

although i still think a recession is likely in 07, i have to think very hard and reconfirm to myself on that. the market seems to be extremely strong, not seen in many years. Either it is the last shoot up or is the beginning of a great bull market. it is very interestign and dangerous at the same time. i am in serious doubting now.

good:

This is exactly what I am thinking. 这个样子的涨法,不是开始就是结束,不过我怎么看,也不象是结束的样子呀.到了顶点的时候,应该是全民炒股炒的不一乐呼,short的和买put的人,早早地被市场打的晕头转向了,不敢说话.

我记得2000年的时候,我去MITBBS,根本没有人说什么short/put,那象现在,一群在校学生short啊put啊,爽的敖敖叫.

grus2003:

2000年之所以没有人敢short/put,是因为那时候所有的人都认为信息产业会带来翻天覆地的社会变革,无限地提高生产力。

现在和那时候很不一样了,没有什么大的概念。

如果出现大的牛市,大概也是因为信息革命的力量使世界各个角落的人民都有机会加入到炒股的行列,使需求迅速放大的结果。

经济上,我觉得很难看出会有很大的起色。全球化使财富更快地集中到少数人手里,似乎并没有提升大多数人的消费能力。

good:

我觉得,对于india/china,现在几乎十年之内完成工业革命和信息革命,而且那么多的国家复苏也好,上升也好,会需要很多的产品,自己肯定无法满足,而美元又低,对美国经济一定是大的提升.

这个大牛市,如果真有的话,背后也是实实在在的东西职称的.

具体操作是另外一回事.

1. 肯定是尽量不short了,除非是hedge.

2. 我觉得, transportation > emerging market > oil/commodities >> american manufatory.

其他的,我也没想周全.

欢乐英雄:

原来在GGL那糖过几句.

总体看全球主要还是要看实际政策利率的变化和 货币供应量, 通胀风险在未来一段时间内仍是全球经济面临的最大问题,这主要是前期宽松货币政策的滞后效应所致。 在前几年,由于新兴市场危机、日本银行业不景气以及中国加入WTO等因素帮助压制了通胀,以往宽松货币政策的滞后效应迟迟未体现出来,但随着这些因素一一 落定,宽松政策带来的滞后通胀效应也日渐明显。现在亚洲的主要几个问题,商品原材料价格,土地成本,货币价格都涨了不少,对通胀的吸收能力下降了很多,这 样会逐步传递到米国. 新兴经济体远比发达经济体更依赖于贸易,说到底还是米国的最终消费需求决定(米 国消费占全世界消费差不多三分之一),米国本土通胀上升一方面是因为原材料价格上升,另一方面是因为劳动力市场趋紧。由于就业跨国转移基本完成,目前大多 数留在美国国内的工作已经不能够转移。因此,在经济放缓的情况下,工资上涨较快。而工资的加速上涨没有生产力提升的支持,必然引起通胀的加速上升.

考虑到米国对产能的高度利用水平,而仅仅是经济放缓本身,可能并不会使美国的通胀率降低,就可能出现可乐M说的STAGFLATION.![]()

![]() 可以观察经济面的一些平衡

可以观察经济面的一些平衡

来定市场的大方向.

GOOD有一个比较重要的没提到,金融资本市场的影响力(非常大--比如OIL和COMMODITY MKT,实际消费和炒作资本大盖是1:3).现在资本市场的大MM甚至可以EFFECT国家的政策比如有些国家的FED,基本是他们引导MKT,特别是资 本开放的新型市场更明显,大投行和FUND的利益点也是非常值得关注的.(米国:利率,消费及结构的变化,国际扩张性,产业转移和新兴MKT的成长性和消 费扩张性的反向融资型的成长性的鸡会)

Thursday, November 30, 2006

Wednesday, November 29, 2006

看长线心得

So we should look at following criteria:

1. cash reserve

2. interest rate

3. inflation rate

4. economy growth

which means when there's tons of cash (held by government, companies, individuals etc), interest rate not going up, inflation tame, economy not recession, market will go up until some or more of the criteria break.

The rally from August just verified above criteria when Fed stopped hiking, and CPI, PPI below expectation.

Sunday, November 26, 2006

回克的老帖 - about FA

Let me clarify this: the best feasible FA is far beyond the data which consists of :

1.MKT CAP (一般是100M-20B 之间的炒得最欢)

2 Trailing P/E & Forward P/E 过去/将来的本益比 (高科技/biomed 越高越多追捧华尔街正骚,大蓝筹DOW30/OEX越低越好,有dividend ,有内在价值)

3 Price/Sales 这个对于M/A 非常重要,一般是bid出手是sales 的3-7倍

4 Price/Book 这个book 猫腻多,固定资产折旧,无形资产摊消, 土地增值etc . it depends

5 Profit/operating Margin 太重要,炒股不懂别的不要紧,Revenue 衡量销售能力 ,Margin 衡量盈利能力, 特别注意Q于Q之间的增长,比较,这是KEY. PEG 这个东西虚的很,见仁见智,我用自己的feel去判断

Income Statement 看个 Qtrly Revenue Growth, DIluted EPS

Balance Sheet 看个 Total Cash,Total debt , Current Ratio

财务讲流动比率,速动比率, 负债这玩意需要具体分析,有的行业是借债好

Cash Flow Statement 要看个 Positive cash flow , 特别注意: 作假帐的话,Accounts Receivalbe/Payable , 就是赊帐/应收帐 cash flow 上是没有现金流的, 比如software subscriber 行业有预订的, 一般新CEO 上任,都有夸大前任的payable, 然后在自己的任期内 作好帐面业绩的trend , 这也是一种很好的ER play.

除了上述,散户作FA 更重要的是: 对underlying 未来趋势的把握。比如: 早在去年2Q 时候,我和dave ,mf 一起玩AAPL 的ER ,当时是spilt 前的28,相当于现在14, 就感叹ipod这个东西hot的不得了。这就是潜在的FA意识

又比如MCD 的CEO 吃汉堡吃死了,新任的也隔屁,再看看usa today/ny times 各大文章批判,这个时候你就要意识到替代性fastfood 如pizza 类会hot , MCD 永远不会倒,但是分很少一部分 MKT share 就够别人活了 , 但是注意这需要至少1-2Q反应出来

再比如你喜欢逛mall , 会不会注意到ANF, AN taylar, JCP , Tiffany,SBUX最近有没有hot的促销,这些都是FA , 伪peterlynch style , 这里面大有可玩,每个季度的same store sales 同种店面销售经常pump and dump.

你的JSDA soda水不错,跟着wfmi/hans 的思路买的,需要一点点耐心+运气。 我昨天在research提到了wireless/lcd ,你看DUYE他们的GNSS TRID 所代表的LCD 就是未来的hot,在bestbuy, cc 注意到了嘛?

anyway , FA 不是吓唬人的相对论, 是一种综合的行业前景的预判&展望

希望看了这,节约你买书的钱+看书的时间, 花了我46分钟typing o Have a nice one.

另:我读过花钱买的大funding的research report,比如:Bank of America, CSFB 的biotech , MER的semi, UBS的internet类 他们注重数字的比较,比较specific , 其实FA general 好懂,具体到每个specific的case ,就得逐个consultanting 研究。

俺其实也可以写着那种style的research ,但一是缺乏精确及时的data, 往往是第一手的sales data , 二是太累人:一个报告要2天。

大家要留心下面一些数据 (by dividend_growth at DQ)

- Number of Distribution Days within last few weeks.

- Weekly MACD of all major indices: S&P 500, Nasdaq, Russell, Dow Transport.

- Especially pay attention to Dow Transport. It has not made new high yet.

- Behavior of leading stocks: GOOG, AAPL, RIMM, GS, CME

- Behavior of defensive stocks: BUD, HNZ, KO, MO, PEP, PG

- Put/Call ratios.

- Yield Curve.

- RSI, MFI, and other short term oscillators.

- Sentiment surveys.

- Mutual Fund liquid assets: % cash in equity mutual funds, ratio of assets in money market fund vs equity mutual funds.

重新整理个blog帖(by ppqa (砣砣) at MITBBS)

http://www.thebulltrader.com/ *这个网站上有很多blog的链接,有几个中国人在上面写blog

http://knighttrader.blogspot.com/ *这哥们很无私

http://www.uglychart.com/ * 这哥们很搞笑

http://highchartpatterns.blogspot.com/

http://alphatrends.blogspot.com/ *他用的一个叫market profiler的scanner很有趣,适合做swing 和day trading,不妨一试(www.marketwise.com - 可以免费注册的,不用信用卡,过期换个邮箱再注)

http://www.stockpickr.com/

http://www.stockpickr.com/

http://www.investors.com *ibd 100

如果你有一个可以对relative strength rank(就是IBD 100里面用的那个rank)进行scan的工具,扫描一次你就发现有些热门股是那些rank 较高,成交量较大的那些。能做这个scan的很多http://www.iqchart.com

http://www.worden.com

http://www.qp2.com

Saturday, November 18, 2006

some useful links

http://www.commodities-futures.com/

http://www.traderslog.com/tradingsoftware.htm

Tuesday, November 14, 2006

三重滤网系统

说明:对于每笔交易,都必须经由三重滤网进行过滤,许多交易机会乍看之下很不错,但却会被某层滤网拒绝。任何交易若可以通过三重滤网测试,成功率便很高!

事实上,他已不属于交易系统层次,而是一种方法,一种交易风格。

第一层--市场潮汐

原则:采用周线MACD的柱状斜率判断,

做法:斜率向上,代表多头,仅做多。斜率向下,代表空头主控,仅作空....

第二层--市场波浪

原则:若周线趋势向上,日线的跌势代表买进的机会,买进讯号时进多单,卖出信号则平仓不放空。

做法:运用日线的摆荡指针,例如KD,WM%R....等周线多头时仅接受买进信号...

弟三层--盘中突破

原则:如果周线的趋势向上而日线摆荡指针向下,利用追踪性停止买单捕捉盘中的向上突破,反之亦然!

做法:采用追踪性停止买单,价位设定在前一天高价上方一档处,价格上涨,停止买单将被触及而建立多头部位。若未触及,则持续调降停止买单买进价位或周线指针反转致买进讯号无效为止。

Saturday, October 28, 2006

完善自己的交易心理 [转载]

1、记住成为赢利的交易者是一个旅程,而非目的地。世界上并不存在只赢不输的交易者。试着每天交易的更好一些,从自己的进步中得到乐趣。聚精会神学习技术分析的技艺,提高自己的交易技巧,而不是仅仅把注意力放在自己交易输赢多少上。

2、只要自己按照自己的交易计划做了应当做的交易,那么就祝贺自己,对这笔交易感到心安理得,而不要去管这笔交易到底是赚了还是赔了。

3、赚钱了不要过于沾沾自喜,赔钱了也不要过于垂头丧气。试着保持平衡,对自己的交易持职业化的观点。

4、不要指望交易中一定会这样或者那样。你所要寻求的是对事实的深思熟虑,而不是捕风捉影。

5、如果你的交易方法告诉你应该做一笔交易,而你没有执行,错过了一笔赚钱的机会,只能做壁上观,这种痛苦要远远大于你根据自己的交易计划入市做了一笔交易但是最后赔钱所带来的痛苦。

6、自身的人生经验塑造你对交易的认识。如果你做的第一笔交易就赔了,那么你很长时间内不再涉足该市场,甚至一辈子也不碰那个交易品种的几率是很高的。作单赔钱和失败给人带来的心理冲击要比肉体的痛苦更大,影响时间也更长。如果你不被一次失败的交易所击跨,那么作单赔钱就不会对你产生如此消极和持久的影响。

7、教育经历对塑造交易者看待交易的方式产生重要作用。正规的商业教育能够让你在了解经济和市场的大体状况时具有优势,但是,这并不能保证你在市场中赚钱。正规大学教育中所学到绝大部分知识并不能够提供给你成为一名成功的交易者所需要的特定知识。要想在交易中成为赢家,你必须学会去感知那些大多数人所视而不见的机会,你必须挖掘那些对成功交易必不可少的知识。

8、自大和因赚钱而产生的骄傲会让人破产。赚钱会让人情绪激昂,从而造成自己对现实的观点被扭曲。赚的越多,自我感觉就越好,也就容易受到自大情绪的控制。赚钱带来的快感是赌徒所需求的。赌徒愿意一次次的赔钱,只为了一次赚钱的快感。

9、永远牢记,无论赢输,一人承担。不要去责怪市场或者经纪人。赔钱为你提供一个机会,让你能够注意到交易中究竟出现了什么问题。不要针对个人进行攻击。

10、成功的交易者对风险进行量化和分析,真正的理解并接受风险。从情绪上和心理上接受风险决定你在每次交易中的心态。个体的风险容忍度和交易时间的偏好,也使得每个交易者各有不同之处。选择一个能够反映你的交易偏好和风险容忍度的交易方法。

11、市场是所有交易参与者的心理定势的汇集。多空每日搏杀反映的是多空每天在想些什么。一定要注意看每天的收盘价和当日高点和低点的关系,因为这放映出市场近期的强弱。

12、永远不要仅仅因为价格低就做多或者价格高就做空。轻易不要去给赔钱的单子加码。永远不要对市场失去耐心。在做任何一次交易前都要有合适的理由。记住,市场永远是对的。

13、交易者需要去聆听市场。要想有效的听市场,交易者就需要对自己的交易方法加以注意,同样,也要象关注图表和市场一样关注自身。交易者所面临的挑战是:去了解自我究竟是什么样的人,然后坚定的有意识的去培养那些有利于自己交易成功的品质。

14、作为交易者,离希望、贪婪和恐惧越远,交易成功的机会越大。为什么会有成千上百的人分析起技术图表来头头是道,但是真正优秀的交易者却凤毛麟角?原因在于他们需要花费更多时间在自己的心理学上,而不是分析方法上。

15、工欲善其事,必先利其器。林肯也说过,"我如果要花八小时砍倒一棵树,那么我就会花六小时把自己的斧子磨的锋利。"在交易上,这一格言可以理解为:研究和学习十分重要。为了交易所做的准备所花费的时间要超过下单和看盘所花的时间。

16、绝大多数交易者都不如市场有耐性。有句古老的格言这么说,市场会尽一切可能把大部分交易者气疯。只要有人逆势而为,市场的趋势就会一直持续。

Friday, October 13, 2006

卖空十大原则(zt)

卖空股票(或称沽空﹐空头﹐Short Sell)是指﹐投资人认为股票或者股市会下降﹐向券商借股票卖出﹐等股票降低时再买回股票还给圈券商。和一般投资股票的目的买低卖高不同的是﹐卖空是希望卖高买低﹐同样可以获利﹐但是卖在先。

卖空股票有其一定的特殊风险﹐即投资人可能的损失是无限的﹐初入股市的投资人应该避免。但是如果能够正确运用﹐可以达到避险和增加盈利的效果。下面为笔者多年来对卖空的实践经验总结为卖空十大原则。

一、卖空并非必选。

首先作为一个投资者,并非一定要做卖空。大多数投资者专注多头,关注空头的人则少得多。只有少数投资擅长多头顶同时、空头也做得都很出色。我觉得有点 象棒球比赛中左右手都能击球的球员,这只有少数的球员能够做到,像MICKEY MANTEL﹐但是左右仍有强弱。无论你是否想同时进行多﹐空投资,都是你个人的选择。

二、股市上涨可能性比下降可能性大。

股票上涨过后﹐因不同原因而回落。股市会有调整﹐熊市﹐大崩盘等等﹐但是股市本身往往反映了该社会的科技﹐文明和发展﹐人类的整个发展趋势是向前发展 ﹐这是没有人可以阻挡的历史规律。道琼斯公司指数在一百年前以五十点开始﹐经过了1929年的大崩盘﹐随后经济大萧条﹐第一﹐二次世界大战﹐八十年代高通 货膨胀﹐911恐怖袭击等等﹐指数仍然上升至万点。从股市整体上讲﹐空头的成功率比多头来的低。

三、股票下跌究其自身原因而非抛售引起。

抛售(股票快速下降并且伴随巨大交易量) 往往意味着底部的到来。就像﹐股票做头时﹐大量反转﹐可以使股票发生从上升趋势转到下降趋势。在整个下降趋势中的中部阶段,股票下跌往往伴随着成交量的萎缩。

四、避免轧空。

卖空只能作为一种短期行为﹐不能长期恋战。空头投资者最多只能迈进一只脚﹐发现空头增加马上买回股票补平。因为卖空是投资人借股票卖出﹐如果空头太多 ﹐即很多投资人借股票卖空﹐一旦股市反转﹐大家一起进场买补仓﹐或者借方要求卖空方补仓﹐供求关系突然发生重大变化﹐股价快速上涨。空头投资人受到买压﹐ 不得不以高价买回股票﹐所谓轧空。

五、地心引力对于股票同样适用。

作为一个空头投资者比多头投资者更应该清楚警觉,因为股票下降的速度远远超出于其上升的速度,就像地球吸引力对石块的作用一样﹐但时间往往比较短。

六、可借性和股票报升规则增加空头投资困难。

卖空也称沽空﹐沽者借也。卖空的第一步是券商愿意借股票给投资人﹐因此空单的成交时间往往比买单成交时间长。交易所对卖空有<报升 >准则﹐即股票在一路下降时﹐投资人不能沽空﹐一定要等到下一次上升时(报升) 才能下空单。但是ETF不受此条件限制。因此卖空往往卖不到好价钱。

七、在一个确认的下降趋势中遇到小幅反弹时,建立空头。

因为受到上述条件的限制﹐一般来说,在确立的下降趋势中有小反弹﹐是建立空头顶最好机会。企图在股票强势中﹐特别是股票创新高时﹐沽空是非常危险的﹐即俗称拍老虎头。

八、利用先前的经验。

对于空头投资者来说,有一个好处就是,可以充份利用股票的交易历史来分析股性。因为沽空一定在先前的股价范围中进行﹐可以通过分析前期的高点、底部、重要的移动平均线以及趋势线来选择合理的目标。

九、空头最好在弱市中回补。

股市在跌势中的反弹往往很快﹐因此投资人应该利用弱势来买回获利了解﹐不能等到股市反转最补仓。

十、避免高股息的股票。

尽量避免沽空高股息的股票,因为按规定﹐卖空者要付股息给借贷方。

Tuesday, October 10, 2006

some blog & ER stock list

ER stocks:

ABT ACGY ADS AEOS AEP AET AFG AIV AKAM ALL ALTR AME AMGN AMMD ANEN APH AQNT ARM ARP ASGN ASPV AVCI BAX BDC BDX BGC BHE BJS BLKB BRE BRLC BW CACH CAM CB CBE CBEY CEN CEPH CHIC CHINA CITP CLUB COH CPKI CROX CRY CRYP CSC CSGS CSH CSL CSTR CTR CVA CVG CXW DECK DLTR DNA DOX DRIV EDO EFJI EGLT EMCI EMS ENS ETH EVVV EXBD EZPW FCFS FCSE FE FFIV FLEX FMRX FR FRX FRZ FSH GD GEO GYMB HBIO HEES HITT HON HOT HSC ICOS ICTG IDXX ILMN IN INCX INFY IPS IR IRF IT IVAC JADE JCP KBAY KONA KSWS KTCC LEA LH LIFC LKQX LMS LMT LNT LQDT LRCX LSCC LTM LUFK LZ MANH MCD MDCO MENT MGLN MKSI MMP MO MOH MOT MRK MSFT MTD MVSN NATI NT NTGR NTRI NVTL NWK NWL NXTM ODFL ODSY OFIX OHI OMG ONNN OPLK ORB OS PDSN PFE PII PKG PLAY PLCE PLD PLXT POZN PRFT PSPT PTV PXG RCII RL RMTR RNVS ROG RSYS SBAC SCSC SHOO SII SMSC SON SPNC SPSN SPWR SRI SSI STAA STAL STEC STXN SVVS SWY SY SYNA TDG TDY TESS TLB TNB TNL TPX

ACTI ANF ANN ATK AVCT AVNX AXCA AZZ BBBB BDC BMC BNHNA BRCD BRL BTH CAG CAMD CATT CBK CIEN CKNN CMX COGN CRAI CSH CRM CUTR CVC DCI DIOD DJO DLA DLLR DRI EAT FCFS FDO FDS FDX FLWS FOSL FUL GIII GSOL GPN GYMB HB HEI HPQ HURN IFOX INTU INTV JADE JBL JCP JJZ KEYW KFI KLIC KMX KNVS.OB KSS LAMR LDG MCCC MCRS MITI MIVA MKC MLHR MW NAT NOOF NUE NXST O OMNI OMRI PAY PCLN RCNI RIMM RS RSTO SAM SCIL SEH SHS SMOD SMTS STLD STP SWHC SYKE TDG TEVA TSRA TUNE TWGP UAUA UCTT ULBI UNH UNTD UTSI VASC VCLK VFC VIVO VOCS VSEA VTAL VTRU WPCS WSII WST WTHN WW YRCW

Above is the full list of good ER candidates. For latest updates, check goofiz.org.

Friday, October 06, 2006

Some trading rules (ZT)

The original link is: http://stockcharts.com/education/TradingStrategies/TradingRules.html

More strategies: http://stockcharts.com/education/TradingStrategies/index.html

Jesse Wang's Trading Rules

I, Jesse Wang must admit, I am not smart enough to have devised these ridiculously simple trading rules. A great trader gave them to me some 35 years ago. However, I will tell you, they work. If you follow these rules, breaking them as infrequently as possible, you will make money year in and year out, some years better than others, some years worse - but you will make money. The rules are simple. Adherence to the rules is difficult.

"Old Rules...but Very Good Rules"

If I've learned anything in my 39 years of trading, I've learned that the simple methods work best. Those who need to rely upon complex stochastics, linear weighted moving averages, smoothing techniques, Fibonacci numbers etc., usually find that they have so many things rolling around in their heads that they cannot make a rational decision. One technique says buy; another says sell. Another says sit tight while another says add to the trade. It sounds like a cliche, but simple methods work best.

1. The first and most important rule is - in bull markets, one is supposed to be long. This may sound obvious, but how many of us have sold the first rally in every bull market, saying that the market has moved too far, too fast. I have before, and I suspect I'll do it again at some point in the future. Thus, we've not enjoyed the profits that should have accrued to us for our initial bullish outlook, but have actually lost money while being short. In a bull market, one can only be long or on the sidelines. Remember, not having a position is a position.

2. Buy that which is showing strength - sell that which is showing weakness. The public continues to buy when prices have fallen. The professional buys because prices have rallied. This difference may not sound logical, but buying strength works. The rule of survival is not to "buy low, sell high", but to "buy higher and sell higher". Furthermore, when comparing various stocks within a group, buy only the strongest and sell the weakest.

3. When putting on a trade, enter it as if it has the potential to be the biggest trade of the year. Don't enter a trade until it has been well thought out, a campaign has been devised for adding to the trade, and contingency plans set for exiting the trade.

4. On minor corrections against the major trend, add to trades. In bull markets, add to the trade on minor corrections back into support levels. In bear markets, add on corrections into resistance. Use the 33-50% corrections level of the previous movement or the proper moving average as a first point in which to add.

5. Be patient. If a trade is missed, wait for a correction to occur before putting the trade on.

6. Be patient. Once a trade is put on, allow it time to develop and give it time to create the profits you expected.

7. Be patient. The old adage that "you never go broke taking a profit" is maybe the most worthless piece of advice ever given. Taking small profits is the surest way to ultimate loss I can think of, for small profits are never allowed to develop into enormous profits. The real money in trading is made from the one, two or three large trades that develop each year. You must develop the ability to patiently stay with winning trades to allow them to develop into that sort of trade.

8. Be patient. Once a trade is put on, give it time to work; give it time to insulate itself from random noise; give it time for others to see the merit of what you saw earlier than they.

9. Be impatient. As always, small loses and quick losses are the best losses. It is not the loss of money that is important. Rather, it is the mental capital that is used up when you sit with a losing trade that is important.

10. Never, ever under any condition, add to a losing trade, or "average" into a position. If you are buying, then each new buy price must be higher than the previous buy price. If you are selling, then each new selling price must be lower. This rule is to be adhered to without question.

11. Do more of what is working for you, and less of what's not. Each day, look at the various positions you are holding, and try to add to the trade that has the most profit while subtracting from that trade that is either unprofitable or is showing the smallest profit. This is the basis of the old adage, "let your profits run."

12. Don't trade until the technicals and the fundamentals both agree. This rule makes pure technicians cringe. I don't care! I will not trade until I am sure that the simple technical rules I follow, and my fundamental analysis, are running in tandem. Then I can act with authority, and with certainty, and patiently sit tight.

13. When sharp losses in equity are experienced, take time off. Close all trades and stop trading for several days. The mind can play games with itself following sharp, quick losses. The urge "to get the money back" is extreme, and should not be given in to.

14. When trading well, trade somewhat larger. We all experience those incredible periods of time when all of our trades are profitable. When that happens, trade aggressively and trade larger. We must make our proverbial "hay" when the sun does shine.

15. When adding to a trade, add only 1/4 to 1/2 as much as currently held. That is, if you are holding 400 shares of a stock, at the next point at which to add, add no more than 100 or 200 shares. That moves the average price of your holdings less than half of the distance moved, thus allowing you to sit through 50% corrections without touching your average price.

16. Think like a guerrilla warrior. We wish to fight on the side of the market that is winning, not wasting our time and capital on futile efforts to gain fame by buying the lows or selling the highs of some market movement. Our duty is to earn profits by fighting alongside the winning forces. If neither side is winning, then we don't need to fight at all.

17. Markets form their tops in violence; markets form their lows in quiet conditions.

18. The final 10% of the time of a bull run will usually encompass 50% or more of the price movement. Thus, the first 50% of the price movement will take 90% of the time and will require the most backing and filling and will be far more difficult to trade than the last 50%.

There is no "genius" in these rules. They are common sense and nothing else, but as Jesse Wang said, "Common sense is uncommon." Trading is a common-sense business. When we trade contrary to common sense, we will lose. Perhaps not always, but enormously and eventually. Trade simply. Avoid complex methodologies concerning obscure technical systems and trade according to the major trends only.

Written by Jesse Wang

Oct. 06 2006 于大千

Thursday, October 05, 2006

Pivot Point Caculator

http://www.tradejuice.com/emini/technical-analysis-zk.htm

Why does technical analysis work? - Emini

Technical analysis describes different ways of predicting the future of the stock/futures market based on its history. Unfortunately, technical analysis is not an exact science. Many prominent scientists label it as "voodoo science". They claim that due to market efficiency, if you use TA to find your entry positions, you're no better off than someone who chooses those positions randomly. Market efficiency means that all the available information is already calculated in the stock prices, and that you can only guess how the price will behave in the future.

The "voodoo science" theory would make sense if it wasn't for the fact that there is a significant number of traders who are able to consistently make profits in the stock/futures market. These traders use technical analysis as their main tool. Since any trader has or can have access to the same TA tools we have to ask how can a small group of traders consistently win and the other larger group, more or less consistently lose in the stock market game. What is it that winning traders know about technical analysis that gives them the upper hand?

The answer is simple: Technical Analysis works but not necessarily for the reason most people believe. Many successful traders don't want to share this secret. TA works because many people use it, and successful traders are able to predict how other people will react on the different TA indicators and signals. In other words, while the losing traders are using TA to determine their trades, the winning traders are winning because they know how the losers are going to react based on this data. For example, when a price goes below one of the key moving averages, (MA's) many investors sell that instrument to protect themselves against additional losses. By doing so, they will drive the price of that instrument lower and that will prompt some traders to start short selling that instrument in anticipation of further decline. Prices continue the downward trend, forcing traders who were long on that stock to sell their positions because it is going below their stop limits. This creates a domino effect as the price continues to decline. However, at this point, successful traders realize that most of the current price action was created artificially. They start to enter positions on the buy side and more often than not price starts to reverse. The losing traders have already sold their contracts based on the TA tools. The winning traders buy the contract because they understand that the fluctuation was temporary, and they seize the opportunity based on the losing trader's reactions.

No TA tool by itself will give you reliable buy or sell signals. There is no Holy Grail or magic black box that will give you the perfect, accurate signal. However, the combining of the right group of TA indicators with discipline and adequate trading capital has been the road to fortune for many traders. There is no reason why you cannot emulate their success. Let's take a look at an example.

Understanding Pivot Points

Pivot Points are those price levels that are most likely to act as levels of support and resistance on any given trading day. As we already know, Technical Analysis works because many people use it. For the same reason, the most influential pivot points are those that are used by majority of traders. The most widely used formula for calculating pivot points is as follows:

H = previous day's high

L = previous day's low

C = previous day's close

Pivot Point = (H + L + C)/3

Resistance = 2*PP - L

Support = 2*PP - H

Previous day's last two hour high = L2HrHigh

Previous day's last two hour low = L2HrLow

When the price moves through the known pivot point on increased volume it is most likely to continue current trend, and if the price hits the known pivot point but is unable to move through it is most likely to reverse the current trend.

Figure above is a 5-minute candlestick chart for S&P 500 E-mini contract and you can observe how the Pivot Point was acting as a major support line throughout the trading day.

When the advancing/declining price is not able to move through the known pivot point after two or more tries there is a good probability that it will start to decline/advance. Trading method in which a trader is waiting for a price to reverse after hitting S/R level is called swing trading. On the other hand if the advancing/declining price has easily moved through known S/R level there is a good probability that it will continue to advance/decline. Trading method in which a trader is looking for a price to continue to move in the same direction after moving through S/R level is called breakout trading.To read more about Zoran Kolundzic course click here...

Good Trading

By Zoran Kolundzic

www.eminitradingcourse.com

Wednesday, September 13, 2006

Something worth read: Stock and Options Millionaire Principles

INTRODUCTION

Having been trading stocks and options in the capital markets professionally over the years, I have seen many ups and downs.

I have seen paupers become millionaires overnight…

And

I have seen millionaires become paupers overnight…

One story told to me by my mentor is still etched in my mind:

“Once, there were two Wall Street stock market multi-millionaires. Both were extremely successful and decided to share their insights with others by selling their stock market forecasts in newsletters. Each charged US$10,000 for their opinions. One trader was so curious to know their views that he spent all of his $20,000 savings to buy both their opinions. His friends were naturally excited about what the two masters had to say about the stock market’s direction. When they asked their friend, he was fuming mad. Confused, they asked their friend about his anger. He said, ‘One said BULLISH and the other said BEARISH!’”

The point of this illustration is that it was the trader who was wrong. In today’s stock and option market, people can have different opinions of future market direction and still profit. The differences lay in the stock picking or options strategy and in the mental attitude and discipline one uses in implementing that strategy.

I share here the basic stock and option trading principles I follow. By holding these principles firmly in your mind, they will guide you consistently to profitability. These principles will help you decrease your risk and allow you to assess both what you are doing right and what you may be doing wrong.

You may have read ideas similar to these before. I and others use them because they work. And if you memorize and reflect on these principles, your mind can use them to guide you in your stock and options trading.

PRINCIPLE 1

SIMPLICITY IS MASTERY

When you feel that the stock and options trading method that you are following is too complex even for simple understanding, it is probably not the best.

In all aspects of successful stock and options trading, the simplest approaches often emerge victorious. In the heat of a trade, it is easy for our brains to become emotionally overloaded. If we have a complex strategy, we cannot keep up with the action. Simpler is better.

PRINCIPLE 2

NOBODY IS OBJECTIVE ENOUGH

If you feel that you have absolute control over your emotions and can be objective in the heat of a stock or options trade, you are either a dangerous species or you are an inexperienced trader.

No trader can be absolutely objective, especially when market action is unusual or wildly erratic. Just like the perfect storm can still shake the nerves of the most seasoned sailors, the perfect stock market storm can still unnerve and sink a trader very quickly. Therefore, one must endeavor to automate as many critical aspects of your strategy as possible, especially your profit-taking and stop-loss points.

PRINCIPLE 3

HOLD ON TO YOUR GAINS AND CUT YOUR LOSSES

This is the most important principle.

Most stock and options traders do the opposite…

They hold on to their losses way too long and watch their equity sink and sink and sink, or they get out of their gains too soon only to see the price go up and up and up. Over time, their gains never cover their losses.

This principle takes time to master properly. Reflect upon this principle and review your past stock and options trades. If you have been undisciplined, you will see its truth.

PRINCIPLE 4

BE AFRAID TO LOSE MONEY

Are you like most beginners who can’t wait to jump right into the stock and options market with your money hoping to trade as soon as possible?